Tax analyst – interact with the corporates and individuals to fill-in types for property and business taxes.

No thesis is needed. Nevertheless, students who have an interest in finishing an important composing job under the supervision of the faculty member may perhaps do so by enrolling within the Tax Seminar course (TX 982).

As outlined, the course price for Diploma in tax regulation differs in different colleges and establishments, and states. Even so, as this can be a diploma course the overall course rate may very well be all-around INR 15000 and 100000.

The online format allows students to start the program in almost any on the a few sessions—tumble, spring, or summer.

Concise Tax Laws 2024 is an invaluable resource for the two students and practitioners alike — giving one source consolidation of all big legislation and regulatory provisions relating to tax legislation in Australia.

With applicable capabilities, a candidate can surely excel inside the marketplace. Some of the most important expertise a candidate have to have to perform nicely in taxation law are mentioned beneath:

The course is usually intended for students who would like to put together for further more scientific tests in the sphere of taxation and law.

This seminar will examine the tax planning for modern public M&A promotions from the practical vantage points of tax counsel advising the buyer and the vendor. The principal focus are going to be on: (1) the tax structure used; (2) the tax representations, warranties, covenants, and indemnification provisions from the acquisition files, along with any tax-sharing agreements; (3) the tax disclosure discussion during the proxy/prospectus shipped to the shareholders; and (four) the form of tax views provided by the buyer’s and the vendor's tax counsel.

Australian tax legislation is designed by statute, so its primary supply lies in laws (Functions of Parliament and delegated legislation like Restrictions). However:

The course will protect the tax repercussions of outbound transfers of assets, foreign-to-foreign transfers of assets, and inbound transfers of belongings. Students will be predicted to have a Doing work understanding of corporate taxation, and transactional facets of subpart F along with the foreign tax credit rating principles.

The customs value of a great is set for a question of regulation, bearing in mind the sort of excellent, its place of origin and the purpose of its import into Australia.

Up coming, taxation law course you can examine the procedure of money distributions accompanied by property distributions. You might then go over the therapy of inventory distributions. Finally, procedure of constructive dividends and skilled dividends are going to be explored.

The biggest challenge of the multistate tax practice is dealing with the sensible problems with several states with sometimes conflicting laws and laws. Most companies operate in multistate atmosphere and should learn how to use their operational realities into a patchwork of state and local tax laws and rules.

The eligibility conditions for a diploma in tax legislation are different in numerous colleges and establishments. Even so, the general and basic eligibility conditions are as listed below.

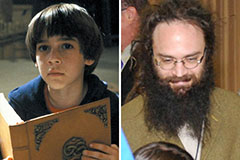

Barret Oliver Then & Now!

Barret Oliver Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!